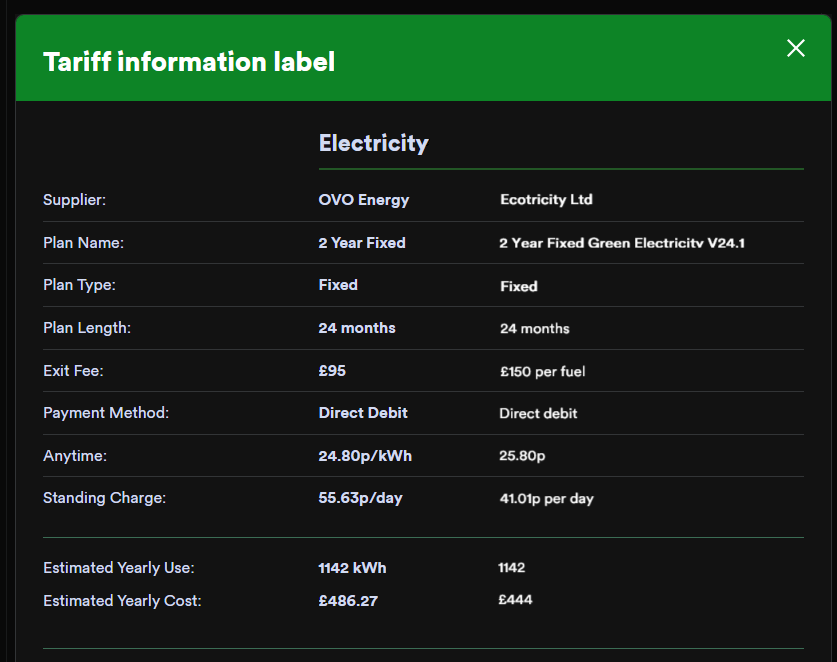

Customers on variable tariffs (SVT) are being notified these days of tariff increases from 1 January. At the same time, many are being given the opportunity to switch to a fixed-rate tariff. I am trying to decide whether it would be a good idea to fix, but I’m not sure I have all the information I need. Gas hasn’t been invented yet in my corner of the world, so I’m only interested in electricity tariffs.

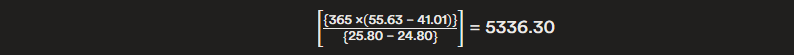

Cornwall Insight are a well respected crystal-ball gazer where energy prices are concerned. Their predictions for 2024 show small ups and downs in unit prices, but one startling forecast is for a hike in the standing charge of the order of 15% on 1 April. For a light user like me, this is hugely significant. On SVT, the standing charge would amount to 37% of my bill in January, but by October this would have risen to more than 41%. The fixed rates I’m being offered would keep the standing charge at more or less the current level, so that makes fixing look like a good idea.

But … we know that Ofgem are considering changes to the way standing charges are calculated and applied. If by some miracle any change were to be implemented before 1 October next, would I miss out on any benefit this might bring? I guess the answer to that is Yes, but that it’s not very likely any change will happen by then. Agree?

And does anyone know the reason for the increase in standing charges predicted for 1 April next? Are we going to be paying for the cost of bailing out Bulb customers?