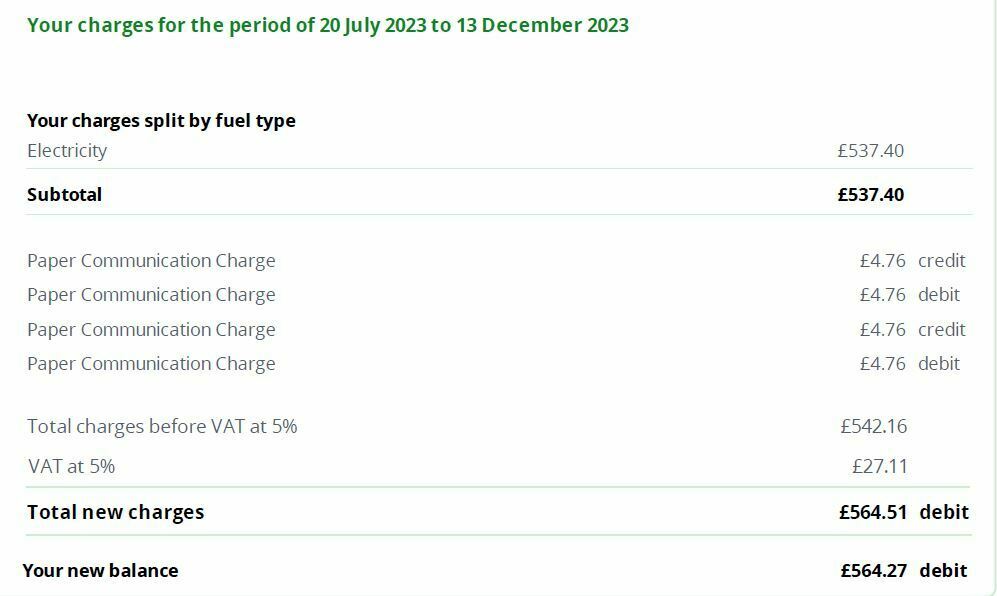

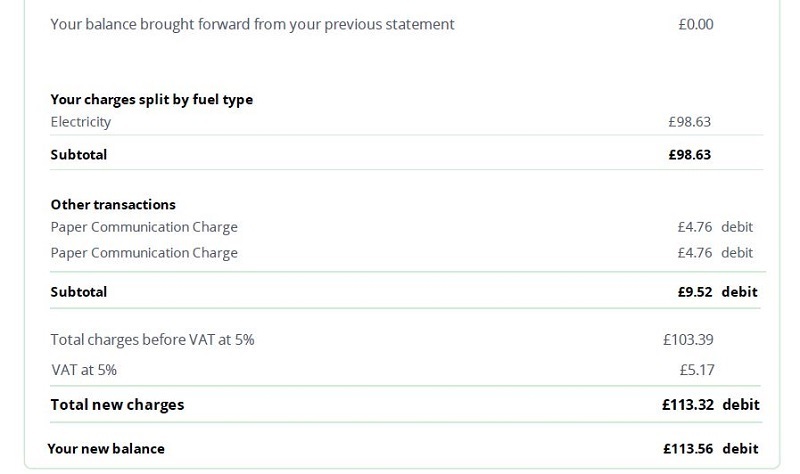

My first bill from OVO.

Really simple : Zero starting balance, + Some electricity, - One paper free discount, + VAT.

These numbers don’t add up.

Statement shows two ‘paper discounts’ totalling £9.52, but the calculation only uses one.

The ‘Total Charges’ don’t match the ‘New Balance’, even though the starting balance was zero.

I know the errors are not significant, just a few pence, but they are wrong !.

It is possible that a human working with a calculator could make a simple error, but I don’t think OVO have rooms full of girls with calculators doing our bills.

It’s probably some kind of computer error, which is worrying. This time it made a 20p error, next time it might be a £20 error.

I’ve phoned, and OVO are ‘looking into it’.

[ EDIT : I was so distracted by the bad calculation that I didn’t notice the Paper Comms items are charges, not discounts. I’ve never had paper comms from OVO. Time for another phone call. ]