Updated on 16/06/25 by Abby_OVO

How we work out your Direct Debit amount

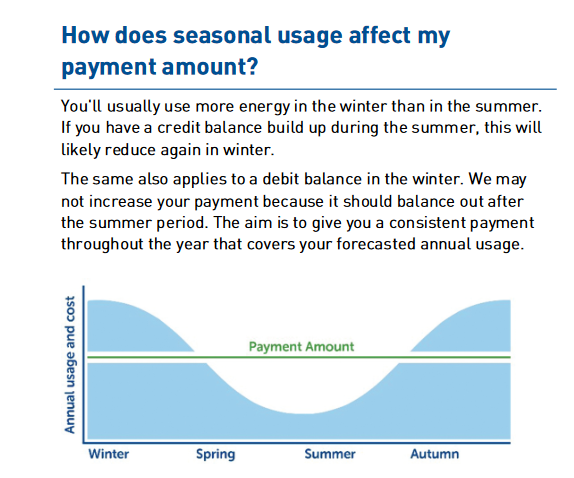

The aim is to make sure you have credit for 1 month’s payment in your OVO account by the end of March. This is to help cover any change in your home energy use over the course of the year.

For new customers, this only comes into effect once you’ve reached March. When you first join, the aim is to make sure you have no balance left to pay after 1 year.

Your Direct Debit payment amount will be regularly reviewed to make sure it still covers your home’s energy use.

If your account isn’t in credit, we're here to help

If your account isn’t in credit, that’s okay and it doesn’t necessarily mean your monthly payments need to change. We’ll let you know if it ever does.

If you’re worried about your payments changing or you can’t afford them, please speak to our team. We can make sure you get financial support that’s tailored to you and your situation. There are many options available for anyone who needs help. To get in touch with our team:

-

Sign up to our online tool at ovoenergy.com/payment-support and we can find the best plan for you.

-

Call us on 0800 408 6615. We’re here Monday to Friday, 9am and 5pm, and 9am to 2pm on Saturday.

-

Talk to us online Monday to Friday, 8am to 6pm, and 9am to 2pm on Saturday.

You’re correct in understanding that you are ‘okay’ to go into a debit balance while on Direct Debit.

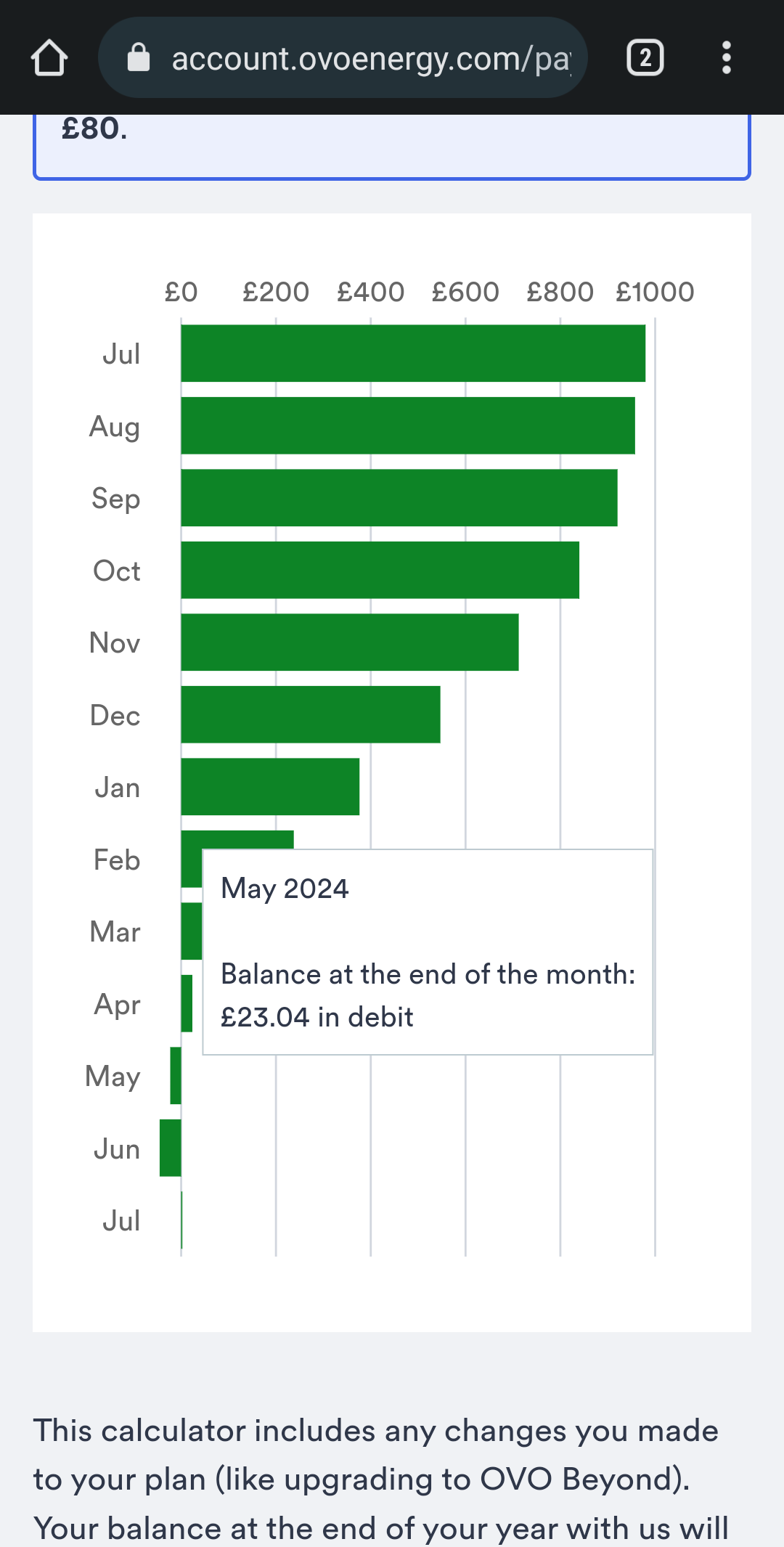

Due to the agreement and the way that this is set up over the year, if you’re in a debit balance, that’s okay, as we intend for the Direct Debit to even out the balance throughout the course of the year. It’s typical for accounts on Direct Debit to go into debit through the winter period, and then build up credit again during summer when you’re maybe not using the heating or lights as much as winter.

If you have any questions specific to your account, you can direct them to the Support Team for more information.

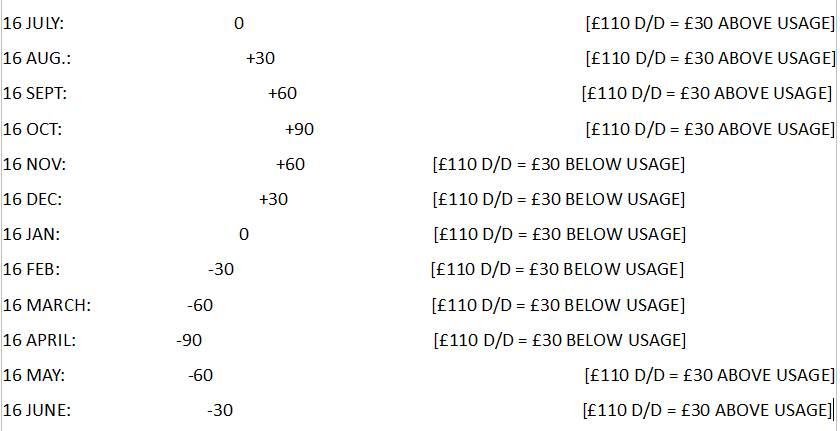

£1320 divided by 12 = £110 per month.

It’s really encouraging to see a customer caring about the state of his account balance instead of simply moaning about the size of the Direct Debit.

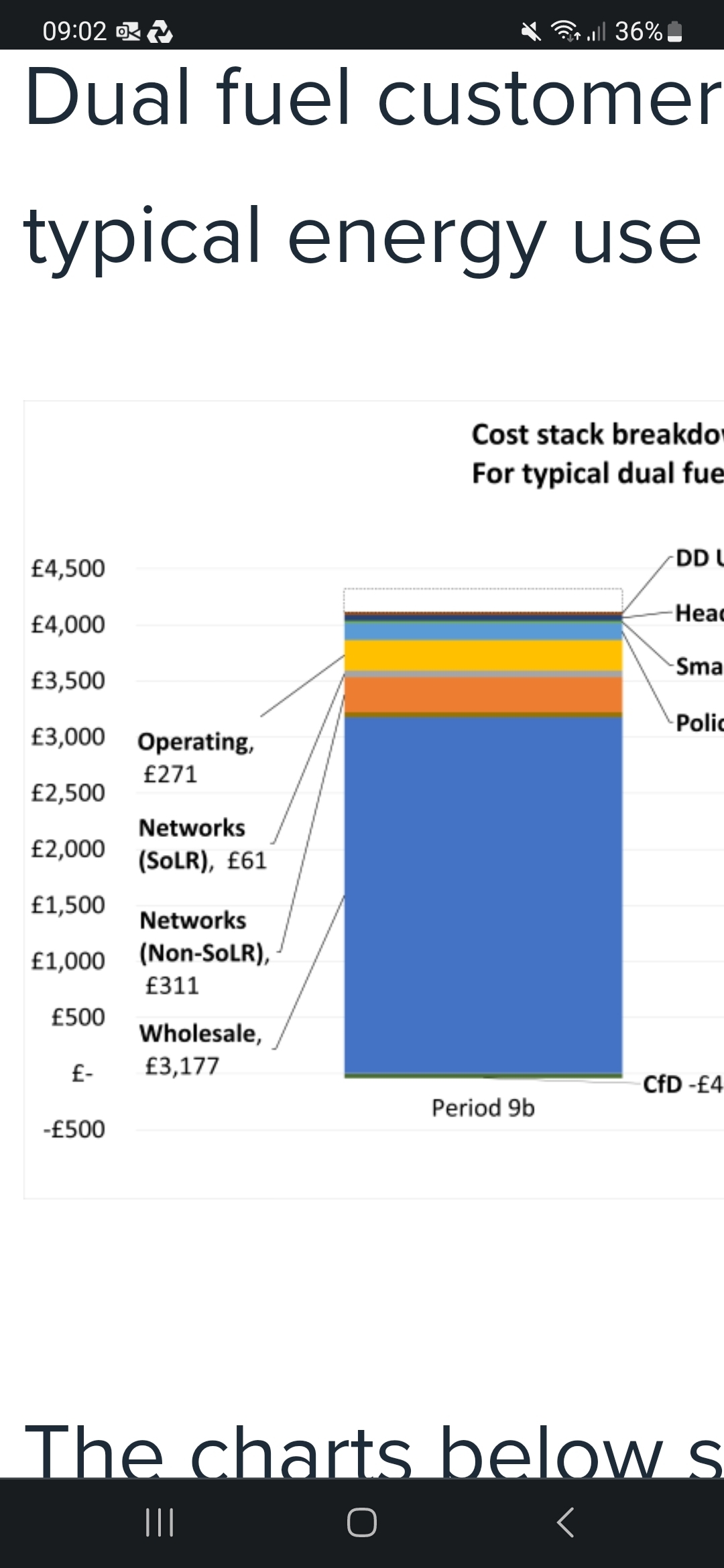

However, you missed an important factor when doing your sums. The calculation for a Standard Variable Tariff is DD = (Current balance less predicted costs) / 12.

If the current balance is negative, then of course the amount has to be added to the predicted costs if the end result is to be zero in a year’s time.

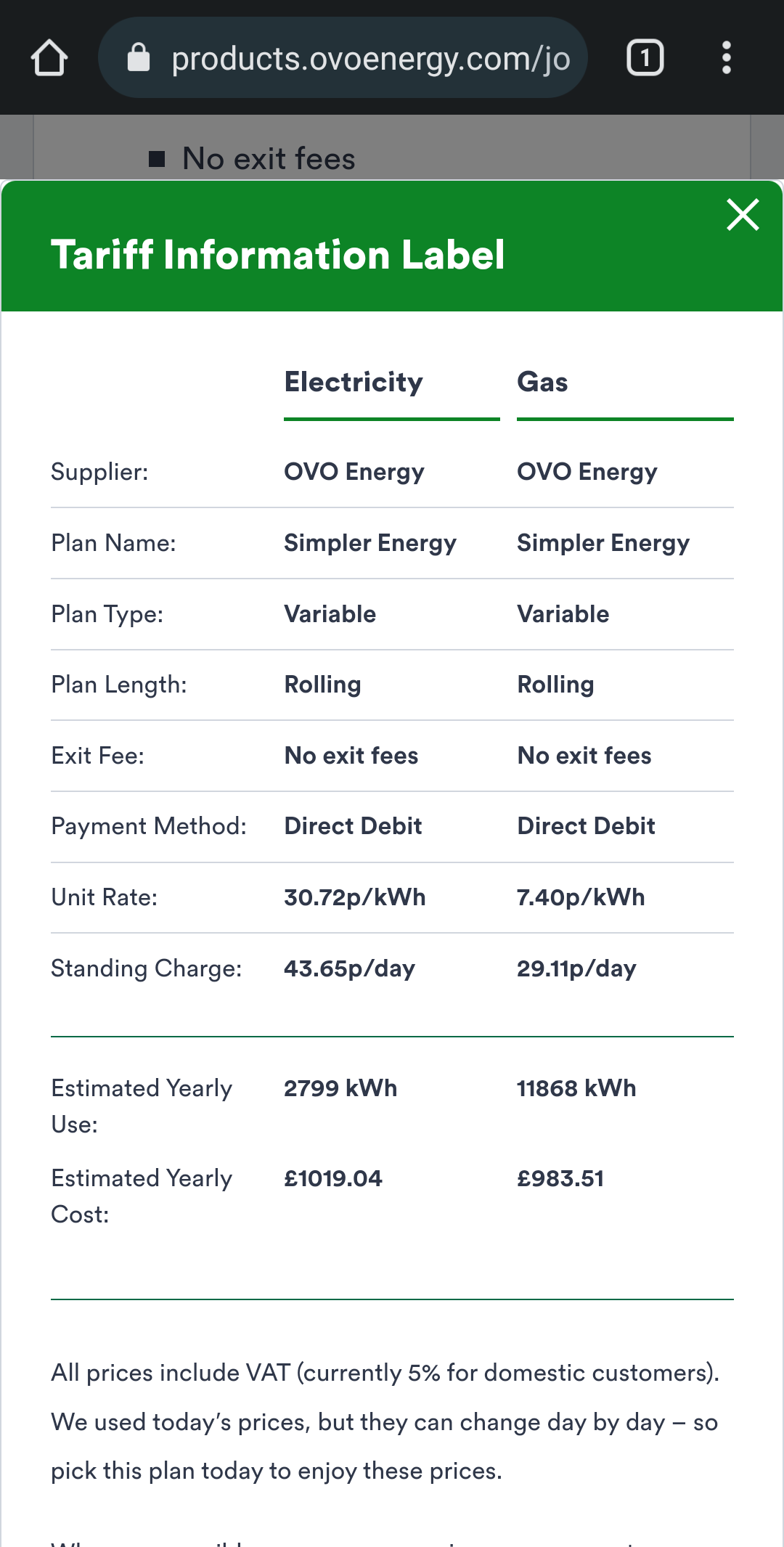

One problem that some customers face is that their estimate of future costs doesn’t always agree with OVO’s. You can see how much energy in kWh they think you’re going to use in the next year on the Plan page of your online account. You’ll have to compare this with your bills to see whether it’s anything like, and it sometimes isn’t.

Once you’ve done your sums: multiplying the amount in kWh by the applicable rate, adding 366 days’-worth of standing charges and adding 5% VAT, you’ll see how close this is to your estimate of £1320.

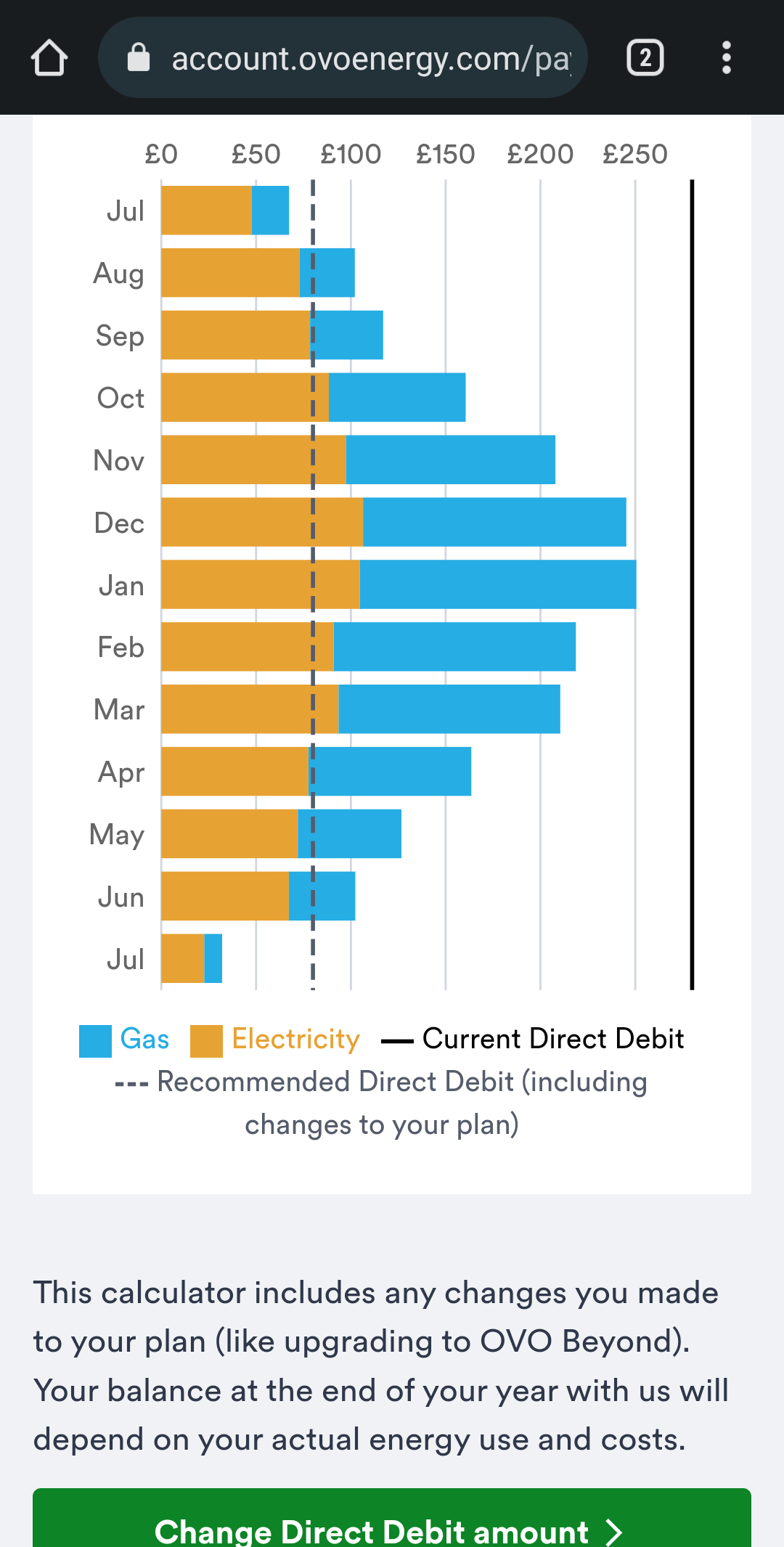

If the calculations in your image are reasonably accurate, I would say that your predicted shortfall of £90 in April isn’t looking good. Quite a lot depends on at what stage in the billing period the DD is taken, but you should really aim for never going into debt, barring unforeseen circumstances, of course. This could be easily remedied by a payment of £90 now, to put your account into credit. The DD calculation would then work out at £103.

The calculator at the website would do this all for you, except that it can’t show you what changing your balance by means of a direct payment would do. And, of course, everything depends on regular meter readings, which is one very good reason to have a smart meter.

OVO don’t charge interest on debt (at the moment), so it’s really up to you and your conscience whether you’d rather take an interest-free loan from them than shell out an extra £90 now for peace of mind. I know what I’d do in your shoes, but I’d be keeping an eye on the Billing pages to be sure of the situation at any particular time. Sadly, I’m not quite sure what you’ll see there, because it’s very different for those like me who have a smart meter. Perhaps you could tell us by means of a screenshot.